With house prices rising, getting on the bottom rung of the property ladder can seem near-impossible. However, for some prospective buyers, the Help to Buy Equity Loan Scheme may offer a path to home ownership. Check out our guide to the most common questions asked about Help to Buy, and see if it’s a good fit for you.

FAQs

What is Help to Buy?

Help to Buy is one of a series of financial schemes the government introduced to make home purchases more affordable. It was also brought in to promote the building of more affordable homes in the UK.

It’s not suitable for everybody, and requires careful consideration. However, it can help those who are eligible get on the property ladder.

Is Help to Buy only for first-time buyers?

The current Help to Buy Equity loan scheme (2021-2023) is exclusively for first-time buyers over 18 years old. The previous scheme permitted buyers who were already homeowners, but this one does not. Be aware that anyone married to, or cohabiting with, anyone who has owned a house is not eligible.

How is the Help to Buy Equity Loan different from the Help to Buy ISA?

The Help to Buy ISA was a previous government scheme that improved a homebuyer’s purchasing power. This was done by adding to the buyer’s ISA funds, increasing the size of their deposit. However, the Help to Buy ISA scheme has now closed.

The current Equity Loan Scheme is a separate scheme. It is also designed to improve homebuyer purchasing power, but in the form of a simple loan from the government.

How does Help to Buy Work?

Help to Buy works by loaning the buyer(s) a percentage value of the home they want to buy. This would then reduce the overall size of a mortgage needed for the remaining value of the home. For example, taking out a 20% equity loan, alongside your 5% deposit, would leave only 75% to be covered by a mortgage.

Generally, smaller mortgages have more attractive interest rates. The buyer is considered less at risk of defaulting on repayments, or falling into negative equity. This is when the home becomes less valuable than the remaining mortgage value.

After 5 years, if the homeowner has not already sold the house, they must start paying interest on the loan. This is calculated on the percentage of equity loan remaining in the property. This payment must be made as well as the mortgage repayments.

What size loan can I get with Help to Buy?

The size of the Help to Buy Equity Loan for most people is between 5% and 20% of the value of the property. However, for those living in London, it can cover up to 40% of the property’s value.

What is the interest on a Help to Buy Equity Loan?

For the first five years, the Help to Buy Equity Loan is interest-free. After that, the interest rate starts at 1.75% of the loan value. This percentage increases each year by RPI inflation plus 2%.

What type of home can I buy using Help to Buy?

Help to Buy can only be used towards the purchase of a brand-new home. Therefore, the scheme is not suitable for those with their sights set on a fixer-upper. If you’re happy with new-build aesthetics, it may be worth investigating property developers in your desired location who are part of the scheme.

What value of property can I buy with help to buy?

Before 2021, the Help to Buy Scheme had a property price cap of £600,000 across England. However, under the current Help to Buy Equity Loan scheme, the ceiling on house value varies by region. Make sure to check the price caps in your chosen area.

For example, the difference in cap between a house in London and the North East is roughly £415,000!

When does the Help to Buy scheme close?

The current Help to Buy Equity Loan scheme began in April 2021. It is due to end in March 2023.

When is the deadline for new applications for Help to Buy?

According to the official UK Government guidelines, new applications for the Help to Buy scheme will close at 6pm on 31 October 2022. To remain eligable, any house purchase arranged under the scheme must be completed by 31st March 2023.

What are the advantages of Help to Buy?

The main benefit of Help to Buy is that it allows you to get onto the property ladder earlier. You still only need a 5% minimum deposit, and it opens up alternative, and potentially cheaper, mortgages.

If you would otherwise be stuck in an expensive rental market whilst saving up for a house deposit, it might be worthwhile to start building equity in your own home instead.

What are the disadvantages of Help to Buy?

The disadvantage of Help to Buy is it brings another stakeholder into the ownership of the property – the government. However, this may enable you to buy the property in the first place. Still, expect a smaller share of any growth in your home’s value while you have the loan in place.

Buyers have the right to pay back the equity loan itself, with 10% minimum repayments. Anything under 20% will have to be paid off in full. This may amount to large sums that take time to build up, especially if the house has skyrocketed in value. Remember that the loan reflects a percentage of the current house value. Its size can rise or fall depending on house prices.

Consider also that this scheme is designed to help first-time buyers get a home. Don’t expect rental income. Though you are permitted to have a lodger reside with you, your property usually cannot be sub-let or tenanted.

Also, be aware that there will be a fee of up to £500 to reserve your desired house.

How do I apply for a Help to Buy Equity Loan?

To apply for a Help to Buy Equity Loan, first you’ll need to find an eligible property in your chosen area. This should be from a reputable homebuilder. Then you need to contact your regional Help to Buy agent. These two parties should be able to answer all your questions and process your application.

If you’re unsure about anything, don’t be afraid to seek independent financial advice. Also, factor in the costs of stamp duty, mortgage fees and legal fees before you start the process.

Is a Help to Buy Equity Loan worth it?

The benefits of an Equity Loan depend on the individual borrower’s capacity to make repayments over time. Less predictable market conditions are also a big factor. However, the scheme can be worth it for first-time buyers struggling to secure a mortgage.

One size does not fit all, especially when it comes to finances. Therefore, it’s necessary for homebuyers to be armed with a good understanding of how and when they will make repayments.

Homebuyers should be aware that the equity loan is linked to housing prices. If your house value goes up sharply during the 5 years, you may need to sell up and move on. Hopefully, you’ll have built up some equity for the next deposit.

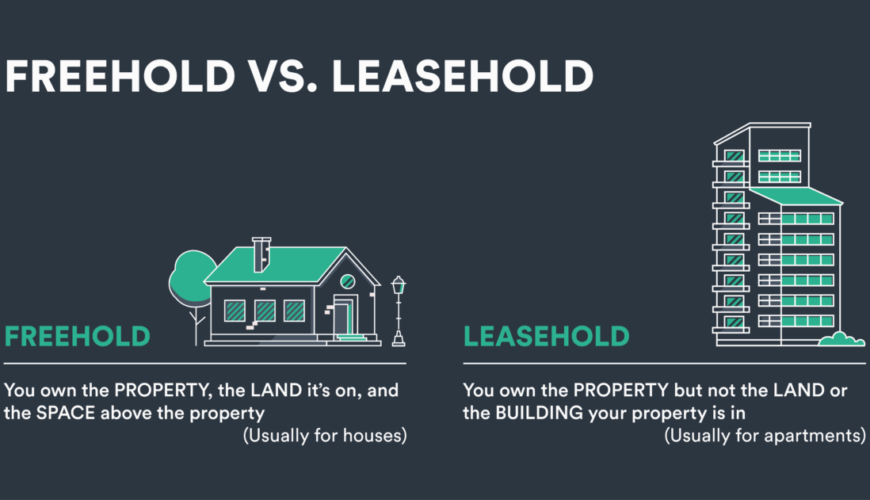

If you’d like to learn any more about help-to-buy schemes, benefits of leasehold vs freehold or technical industry jargon like loan to value, the HomeViews guides below are a great introduction to these subjects.

Read more

HomeViews provides verified resident reviews of the UK’s housing developments. We’re working with developers, house builders, operators, housing associations and the Government to recognise high performers and help improve standards in the built environment.